Page 59 - Annual report eng 2019

P. 59

Tycoons Worldwide Group (Thailand) Plc.

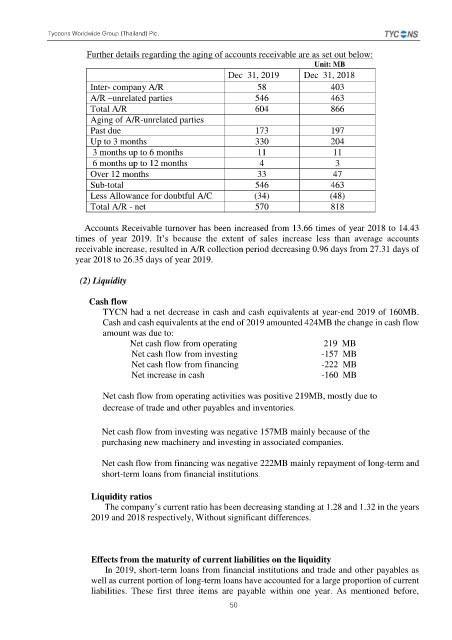

Further details regarding the aging of accounts receivable are as set out below:

Unit: MB

Dec 31, 2019 Dec 31, 2018

Inter- company A/R 58 403

A/R –unrelated parties 546 463

Total A/R 604 866

Aging of A/R-unrelated parties

Past due 173 197

Up to 3 months 330 204

3 months up to 6 months 11 11

6 months up to 12 months 4 3

Over 12 months 33 47

Sub-total 546 463

Less Allowance for doubtful A/C (34) (48)

Total A/R - net 570 818

Accounts Receivable turnover has been increased from 13.66 times of year 2018 to 14.43

times of year 2019. It’s because the extent of sales increase less than average accounts

receivable increase, resulted in A/R collection period decreasing 0.96 days from 27.31 days of

year 2018 to 26.35 days of year 2019.

(2) Liquidity

Cash flow

TYCN had a net decrease in cash and cash equivalents at year-end 2019 of 160MB.

Cash and cash equivalents at the end of 2019 amounted 424MB the change in cash flow

amount was due to:

Net cash flow from operating 219 MB

Net cash flow from investing -157 MB

Net cash flow from financing -222 MB

Net increase in cash -160 MB

Net cash flow from operating activities was positive 219MB, mostly due to

decrease of trade and other payables and inventories.

Net cash flow from investing was negative 157MB mainly because of the

purchasing new machinery and investing in associated companies.

Net cash flow from financing was negative 222MB mainly repayment of long-term and

short-term loans from financial institutions.

Liquidity ratios

The company’s current ratio has been decreasing standing at 1.28 and 1.32 in the years

2019 and 2018 respectively, Without significant differences.

Effects from the maturity of current liabilities on the liquidity

In 2019, short-term loans from financial institutions and trade and other payables as

well as current portion of long-term loans have accounted for a large proportion of current

liabilities. These first three items are payable within one year. As mentioned before,

50