Page 83 - Annual report eng 2019

P. 83

Tycoons Worldwide Group (Thailand) Plc.

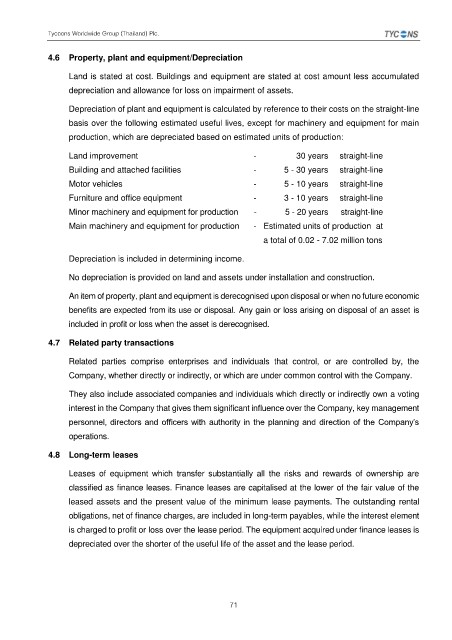

4.6 Property, plant and equipment/Depreciation

Land is stated at cost. Buildings and equipment are stated at cost amount less accumulated

depreciation and allowance for loss on impairment of assets.

Depreciation of plant and equipment is calculated by reference to their costs on the straight-line

basis over the following estimated useful lives, except for machinery and equipment for main

production, which are depreciated based on estimated units of production:

Land improvement - 30 years straight-line

Building and attached facilities - 5 - 30 years straight-line

Motor vehicles - 5 - 10 years straight-line

Furniture and office equipment - 3 - 10 years straight-line

Minor machinery and equipment for production - 5 - 20 years straight-line

Main machinery and equipment for production - Estimated units of production at

a total of 0.02 - 7.02 million tons

Depreciation is included in determining income.

No depreciation is provided on land and assets under installation and construction.

An item of property, plant and equipment is derecognised upon disposal or when no future economic

benefits are expected from its use or disposal. Any gain or loss arising on disposal of an asset is

included in profit or loss when the asset is derecognised.

4.7 Related party transactions

Related parties comprise enterprises and individuals that control, or are controlled by, the

Company, whether directly or indirectly, or which are under common control with the Company.

They also include associated companies and individuals which directly or indirectly own a voting

interest in the Company that gives them significant influence over the Company, key management

personnel, directors and officers with authority in the planning and direction of the Company’s

operations.

4.8 Long-term leases

Leases of equipment which transfer substantially all the risks and rewards of ownership are

classified as finance leases. Finance leases are capitalised at the lower of the fair value of the

leased assets and the present value of the minimum lease payments. The outstanding rental

obligations, net of finance charges, are included in long-term payables, while the interest element

is charged to profit or loss over the lease period. The equipment acquired under finance leases is

depreciated over the shorter of the useful life of the asset and the lease period.

71