Page 157 - Microsoft Word - One-Report-Eng 2024 Final.docx

P. 157

Tycoons Worldwide Group (Thailand) Plc.

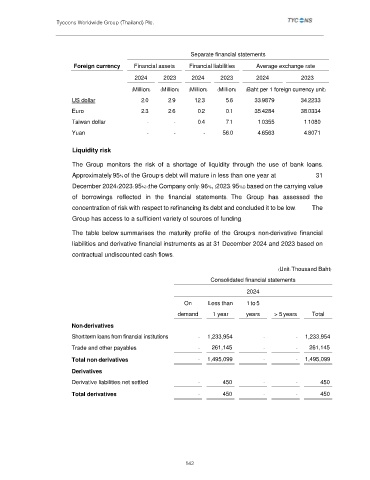

Separate financial statements

Foreign currency Financial assets Financial liabilities Average exchange rate

2024 2023 2024 2023 2024 2023

(Million) (Million) (Million) (Million) (Baht per 1 foreign currency unit)

US dollar 2.0 2.9 12.3 5.6 33.9879 34.2233

Euro 2.3 2.6 0.2 0.1 35.4284 38.0334

Taiwan dollar - - 0.4 7.1 1.0355 1.1080

Yuan - - - 56.0 4.6563 4.8071

Liquidity risk

The Group monitors the risk of a shortage of liquidity through the use of bank loans.

Approximately 95% of the Group’s debt will mature in less than one year at 31

December 2024 (2023: 95%) (the Company only: 96%, (2023: 95%)) based on the carrying value

of borrowings reflected in the financial statements. The Group has assessed the

concentration of risk with respect to refinancing its debt and concluded it to be low. The

Group has access to a sufficient variety of sources of funding.

The table below summarises the maturity profile of the Group’s non-derivative financial

liabilities and derivative financial instruments as at 31 December 2024 and 2023 based on

contractual undiscounted cash flows.

(Unit: Thousand Baht)

Consolidated financial statements

2024

On Less than 1 to 5

demand 1 year years > 5 years Total

Non-derivatives

Short-term loans from financial institutions - 1,233,954 - - 1,233,954

Trade and other payables - 261,145 - - 261,145

Total non-derivatives - 1,495,099 - - 1,495,099

Derivatives

Derivative liabilities: net settled - 450 - - 450

Total derivatives - 450 - - 450

142