Page 107 - Annual report eng 2019

P. 107

Tycoons Worldwide Group (Thailand) Plc.

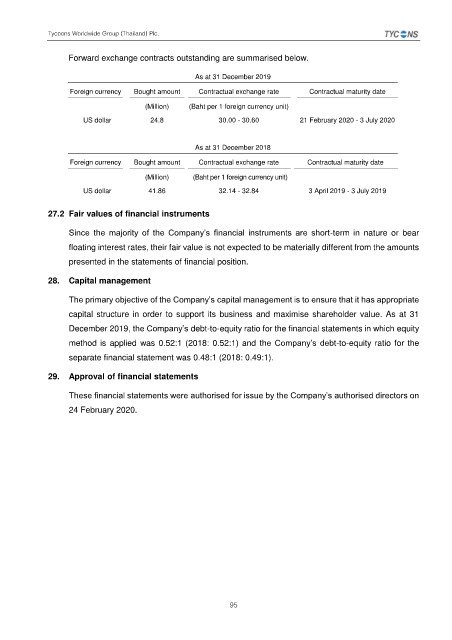

Forward exchange contracts outstanding are summarised below.

As at 31 December 2019

Foreign currency Bought amount Contractual exchange rate Contractual maturity date

(Million) (Baht per 1 foreign currency unit)

US dollar 24.8 30.00 - 30.60 21 February 2020 - 3 July 2020

As at 31 December 2018

Foreign currency Bought amount Contractual exchange rate Contractual maturity date

(Million) (Baht per 1 foreign currency unit)

US dollar 41.86 32.14 - 32.84 3 April 2019 - 3 July 2019

27.2 Fair values of financial instruments

Since the majority of the Company’s financial instruments are short-term in nature or bear

floating interest rates, their fair value is not expected to be materially different from the amounts

presented in the statements of financial position.

28. Capital management

The primary objective of the Company’s capital management is to ensure that it has appropriate

capital structure in order to support its business and maximise shareholder value. As at 31

December 2019, the Company’s debt-to-equity ratio for the financial statements in which equity

method is applied was 0.52:1 (2018: 0.52:1) and the Company’s debt-to-equity ratio for the

separate financial statement was 0.48:1 (2018: 0.49:1).

29. Approval of financial statements

These financial statements were authorised for issue by the Company’s authorised directors on

24 February 2020.

95