Page 144 - Microsoft Word - One-Report-Eng 2024 Final.docx

P. 144

Tycoons Worldwide Group (Thailand) Plc.

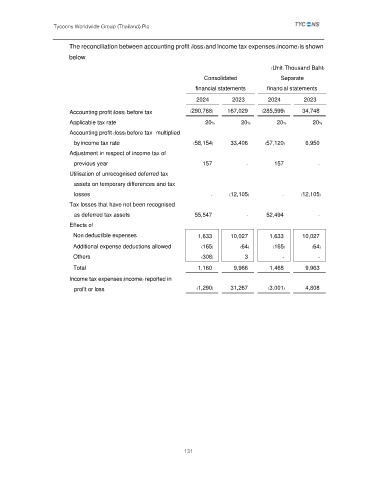

The reconciliation between accounting profit (loss) and income tax expenses (income) is shown

below.

(Unit: Thousand Baht)

Consolidated Separate

financial statements financial statements

2024 2023 2024 2023

Accounting profit (loss) before tax (290,768) 167,029 (285,599) 34,748

Applicable tax rate 20% 20% 20% 20%

Accounting profit (loss) before tax multiplied

by income tax rate (58,154) 33,406 (57,120) 6,950

Adjustment in respect of income tax of

previous year 157 - 157 -

Utilisation of unrecognised deferred tax

assets on temporary differences and tax

losses - (12,105) - (12,105)

Tax losses that have not been recognised

as deferred tax assets 55,547 - 52,494 -

Effects of

Non-deductible expenses 1,633 10,027 1,633 10,027

Additional expense deductions allowed (165) (64) (165) (64)

Others (308) 3 - -

Total 1,160 9,966 1,468 9,963

Income tax expenses (income) reported in

profit or loss (1,290) 31,267 (3,001) 4,808

131