Page 145 - Microsoft Word - One-Report-Eng 2024 Final.docx

P. 145

Tycoons Worldwide Group (Thailand) Plc.

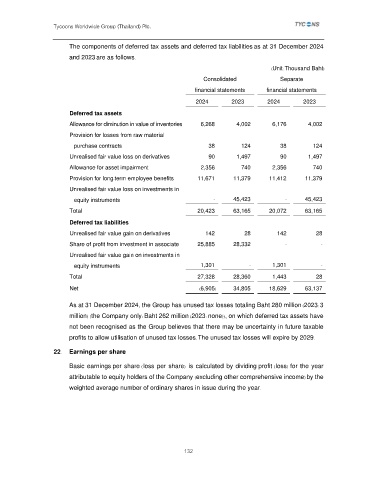

The components of deferred tax assets and deferred tax liabilities as at 31 December 2024

and 2023 are as follows.

(Unit: Thousand Baht)

Consolidated Separate

financial statements financial statements

2024 2023 2024 2023

Deferred tax assets

Allowance for diminution in value of inventories 6,268 4,002 6,176 4,002

Provision for losses from raw material

purchase contracts 38 124 38 124

Unrealised fair value loss on derivatives 90 1,497 90 1,497

Allowance for asset impairment 2,356 740 2,356 740

Provision for long-term employee benefits 11,671 11,379 11,412 11,379

Unrealised fair value loss on investments in

equity instruments - 45,423 - 45,423

Total 20,423 63,165 20,072 63,165

Deferred tax liabilities

Unrealised fair value gain on derivatives 142 28 142 28

Share of profit from investment in associate 25,885 28,332 - -

Unrealised fair value gain on investments in

equity instruments 1,301 - 1,301 -

Total 27,328 28,360 1,443 28

Net (6,905) 34,805 18,629 63,137

As at 31 December 2024, the Group has unused tax losses totaling Baht 280 million (2023: 3

million) (the Company only: Baht 262 million (2023: none)), on which deferred tax assets have

not been recognised as the Group believes that there may be uncertainty in future taxable

profits to allow utilisation of unused tax losses. The unused tax losses will expire by 2029.

22. Earnings per share

Basic earnings per share (loss per share) is calculated by dividing profit (loss) for the year

attributable to equity holders of the Company (excluding other comprehensive income) by the

weighted average number of ordinary shares in issue during the year.

132