Page 101 - Annual report eng 2019

P. 101

Tycoons Worldwide Group (Thailand) Plc.

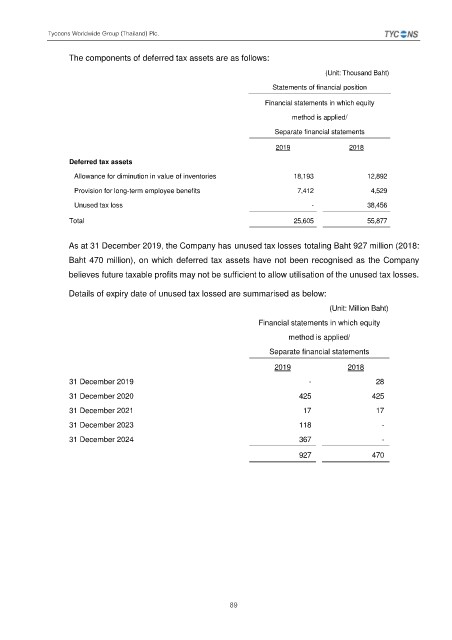

The components of deferred tax assets are as follows:

(Unit: Thousand Baht)

Statements of financial position

Financial statements in which equity

method is applied/

Separate financial statements

2019 2018

Deferred tax assets

Allowance for diminution in value of inventories 18,193 12,892

Provision for long-term employee benefits 7,412 4,529

Unused tax loss - 38,456

Total 25,605 55,877

As at 31 December 2019, the Company has unused tax losses totaling Baht 927 million (2018:

Baht 470 million), on which deferred tax assets have not been recognised as the Company

believes future taxable profits may not be sufficient to allow utilisation of the unused tax losses.

Details of expiry date of unused tax lossed are summarised as below:

(Unit: Million Baht)

Financial statements in which equity

method is applied/

Separate financial statements

2019 2018

31 December 2019 - 28

31 December 2020 425 425

31 December 2021 17 17

31 December 2023 118 -

31 December 2024 367 -

927 470

89