Page 100 - Annual report eng 2019

P. 100

Tycoons Worldwide Group (Thailand) Plc.

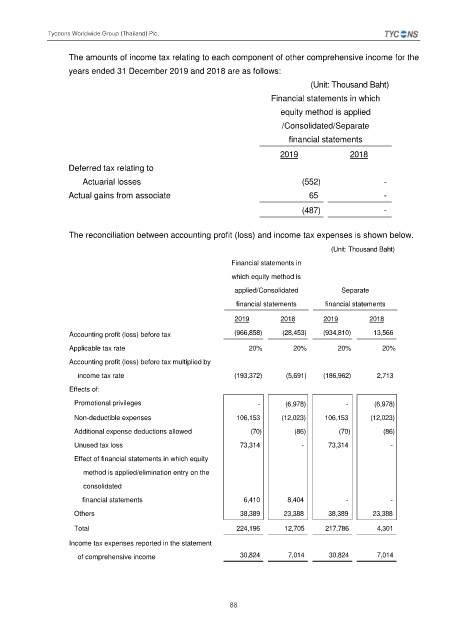

The amounts of income tax relating to each component of other comprehensive income for the

years ended 31 December 2019 and 2018 are as follows:

(Unit: Thousand Baht)

Financial statements in which

equity method is applied

/Consolidated/Separate

financial statements

2019 2018

Deferred tax relating to

Actuarial losses (552) -

Actual gains from associate 65 -

(487) -

The reconciliation between accounting profit (loss) and income tax expenses is shown below.

(Unit: Thousand Baht)

Financial statements in

which equity method is

applied/Consolidated Separate

financial statements financial statements

2019 2018 2019 2018

Accounting profit (loss) before tax (966,858) (28,453) (934,810) 13,566

Applicable tax rate 20% 20% 20% 20%

Accounting profit (loss) before tax multiplied by

income tax rate (193,372) (5,691) (186,962) 2,713

Effects of:

Promotional privileges - (6,978) - (6,978)

Non-deductible expenses 106,153 (12,023) 106,153 (12,023)

Additional expense deductions allowed (70) (86) (70) (86)

Unused tax loss 73,314 - 73,314 -

Effect of financial statements in which equity

method is applied/elimination entry on the

consolidated

financial statements 6,410 8,404 - -

Others 38,389 23,388 38,389 23,388

Total 224,196 12,705 217,786 4,301

Income tax expenses reported in the statement

of comprehensive income 30,824 7,014 30,824 7,014

88